- / Blog

- / General Insurance Landscape

General Insurance Landscape

GENERAL INSURANCE PREMIUM PRICING – OUTLOOK FOR 2024/25

As your dedicated Insurance Adviser, we constantly monitor the insurance market to better understand insurance trends and how they may affect your business.

Having appropriate sums insured for the current replacement value of your assets, stock, contents and machinery is crucial. The recent impacts of inflation, labour shortages, persistent lower AU$ at around 0.65 Cents (Sept 2023) and supply chain issues have caused a dramatic increase in the costs to rebuild/repair properties and replace items. It’s important that we work together to ensure you have the correct valuations and sums insured for your insurance policies. As your Adviser, we recommend that your property and other asset values be reviewed regularly to ensure you’re adequately insured.

Having incorrect insured values could result in an adjusted claim due to underinsurance, meaning you are paid less than you need to replace your property. Having a professional valuation

can help to prevent this. Our team can arrange access to experienced quantity surveyors who can accurately confirm rebuild costs for commercial and domestic buildings, in addition to plant and

machinery.

Pricing Outlook:

The following are some of the key “positives” and “negatives” that will impact insurance premiums over the next 12-18 months.

Positives:

– Continued improved profitability of Insurers, mainly due to improved investment returns.

– The Bureau of Meteorology has now confirmed an El Niño weather pattern. This means drier and hotter conditions for much of Australia, indicating increased potential for droughts and bushfires.

Negatives:

– Extreme weather events are still likely.

– Increased Reinsurance rates for Catastrophe Insurance that Insurers purchase due to the significant weather-related claims that occurred in 2022.

– Continuing inflation impacting sums insureds and rebuilding costs coupled with persistent lower AU$.

Given the large number of weather-related claims paid and increased reinsurance costs, we believe pricing increases will continue on the same trajectory we have seen over the last few years. The continued hard market will see average increases in the vicinity of 9% – 12% for commercial insurance, 15% – 20% for property risks and home and motor insurance increases of 7%+.

There will be some potential easing of Liability/Professional line classes due to the longer-term improved outlook for investment returns on reserves held for liability classes of insurance, particularly if inflation does continue to moderate, hence lowering the impact of claims inflation on claims reserves held by Insurers.

With the continuing hard market, we anticipate:

A continued period of higher or increasing premiums

Obtaining insurance coverage could remain a challenge and become harder to negotiate terms

Insurers are still reducing capacity on certain occupational risks or industry groups or clients with adverse claims history

Higher excesses

Focus on risk management and mitigation processes

More time and additional information is required to place or renew insurance

We must continue our joint effort to maintain policy terms and conditions, even with increasing prices. After all, as our experience consistently shows, we can achieve the best terms and premium outcomes by working together.

Looking to the future:

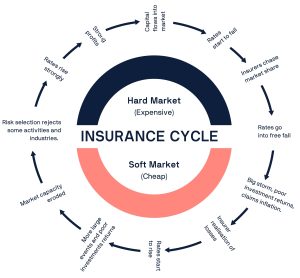

The Insurance Industry, we believe, is at 10 o’clock on the Insurance Clock. How long it remains there largely depends on the frequency and severity of future catastrophic weather events and the continued lowering of inflation impacting claims repair costs. We believe average premium increases will remain in the range of 9% – 20%. The exact figures will be influenced by industry sector, geographic location, prior claims experience and approach to risk management.

Structural change and cost cycles are part of every industry. The Insurance Clock is a useful tool to represent where Insurance rates are now and where they’re likely to be heading in the future.

Should you have any questions or would like to arrange a property and asset valuation or discuss any other general insurance needs, please don’t hesitate to get in touch:

1300 MY ADROIT | mail@adroit.com.au | www.adroit.com.au